Ohio insurance rates play a crucial role in determining the financial protection individuals receive. From the key factors influencing these rates to the various types of insurance available, let’s delve into this complex yet essential topic.

As we explore the nuances of insurance rates in Ohio, we will uncover strategies to lower these rates and gain insights into the regulatory environment shaping the insurance landscape in the state.

Factors Affecting Ohio Insurance Rates

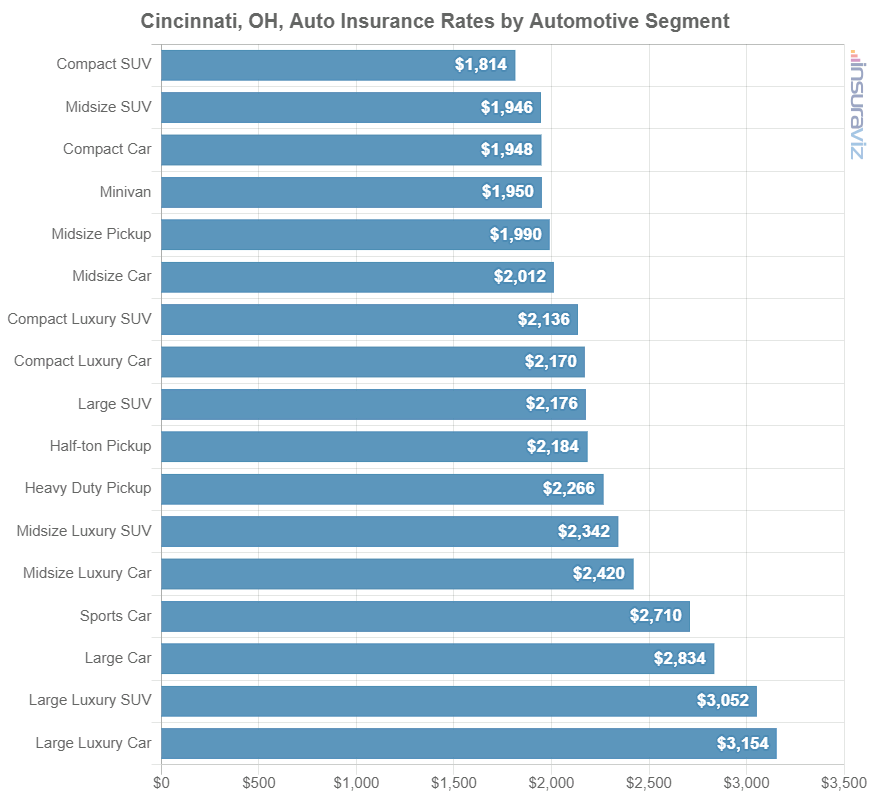

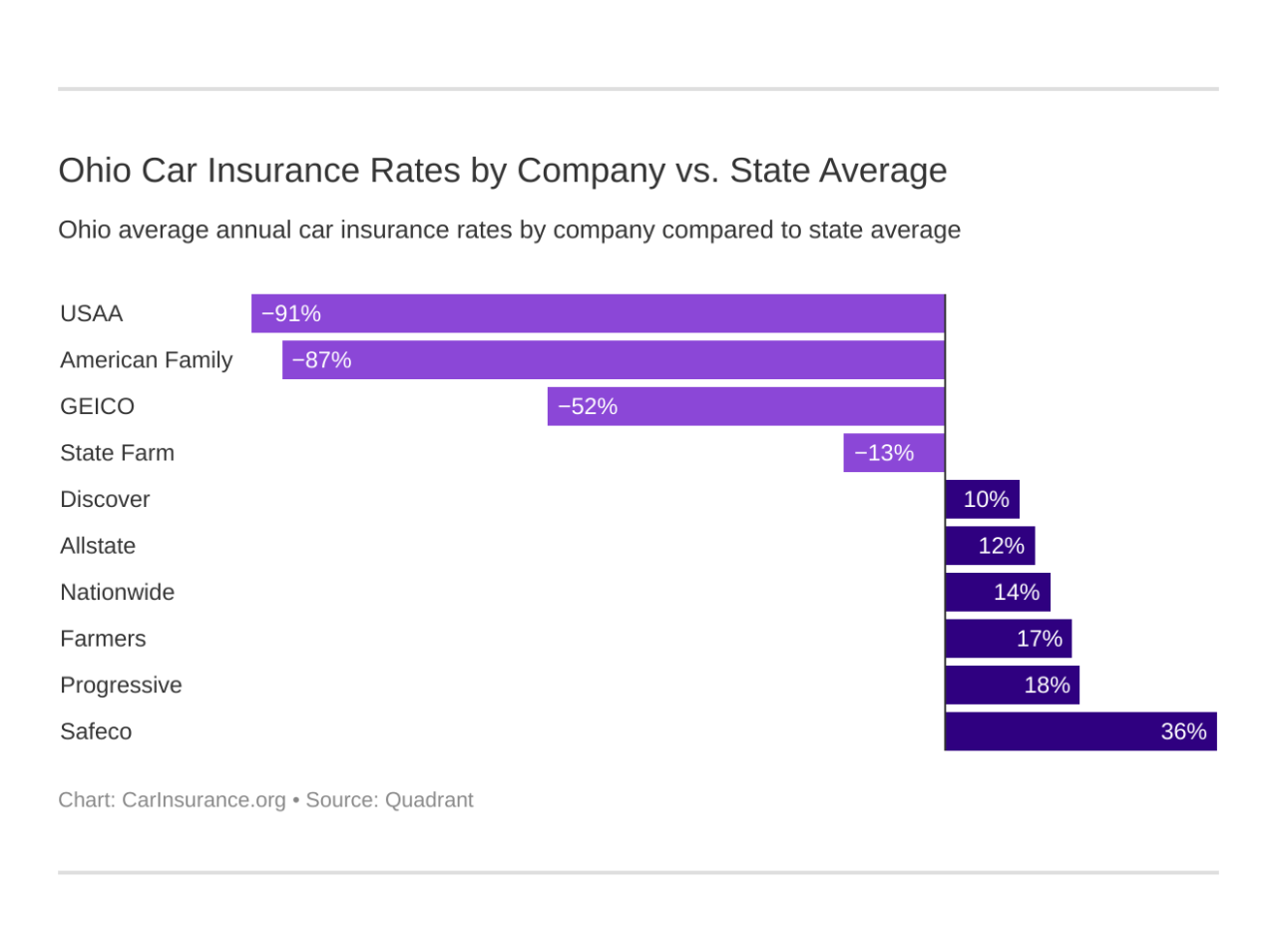

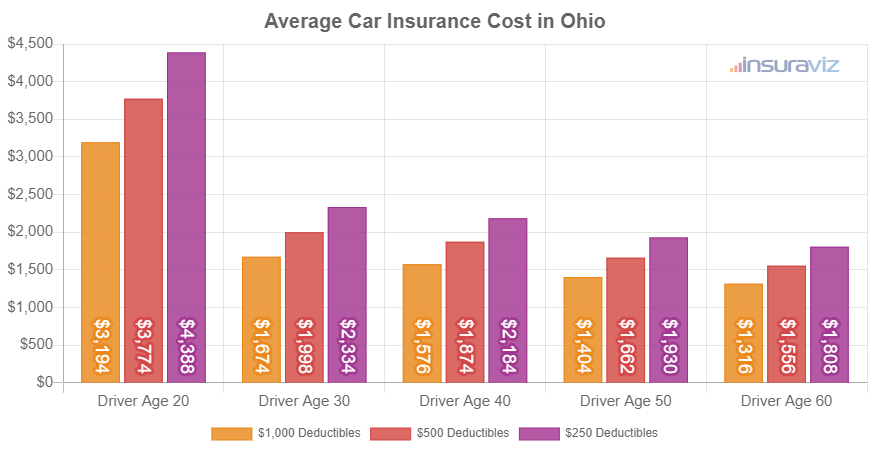

Ohio insurance rates are influenced by several key factors that can impact the premiums individuals pay for coverage. Demographic factors such as age, gender, and location play a significant role in determining insurance rates. Additionally, factors like driving record, credit score, and the type of coverage selected can also affect insurance premiums. It is essential to compare the impact of different insurance providers on rates to find the best coverage at the most competitive price.

Types of Insurance Available in Ohio

In Ohio, residents have access to various types of insurance coverage, including auto, home, health, and life insurance. Each type of insurance offers different levels of protection and benefits. It is crucial to understand the differences between these options and how bundling policies may impact overall insurance rates. Ohio residents may also have unique insurance offerings available to them, so exploring all available options is essential.

Ways to Lower Insurance Rates in Ohio, Ohio insurance rates

There are strategies individuals can employ to lower insurance rates in Ohio. Raising deductibles, adjusting coverage limits, installing security systems, and taking advantage of safe driving discounts are all effective ways to reduce insurance premiums. Additionally, negotiating with insurance providers for better rates can help lower overall insurance costs for Ohio residents.

Regulatory Environment for Insurance in Ohio

The regulatory framework for insurance companies in Ohio plays a crucial role in shaping insurance rates. State-specific laws and regulations can impact how insurance providers set their pricing and offer coverage to consumers. Understanding the regulatory environment can help consumers make informed decisions about their insurance coverage and better navigate the insurance market in Ohio.

Ultimate Conclusion: Ohio Insurance Rates

In conclusion, understanding Ohio insurance rates is not just about numbers; it’s about making informed decisions to safeguard your financial well-being. By applying the right strategies and staying informed about regulatory changes, you can navigate the world of insurance with confidence.

Question Bank

What factors influence Ohio insurance rates?

Factors such as age, gender, location, driving record, credit score, and type of coverage can impact insurance rates in Ohio.

What types of insurance are available in Ohio?

Ohio offers various types of insurance coverage including auto, home, health, and life insurance, with options to bundle policies for potential rate reductions.

How can I lower my insurance rates in Ohio?

You can lower insurance rates in Ohio by raising deductibles, adjusting coverage limits, installing security systems, and seeking safe driving discounts while negotiating with providers for better rates.

What is the regulatory framework for insurance companies in Ohio?

Ohio has specific laws and regulations that impact insurance rates, and understanding these regulatory changes can help consumers comprehend insurance pricing better.